Analyze This: What Is an Order Book and Who Fills It?

How does one predict the behavior of the rate of a cryptocurrency in terms of the number of orders placed?

What is the nature of the process of buying or selling a cryptocurrency on an online exchange? Let us say you want to buy one Bitcoin for $9,500. Then you need to declare this desire to the market and the potential sellers by issuing an order. Sellers appear the same way by declaring their desire to sell Bitcoin at a particular price. When the desires of the sellers coincide with the capabilities of the buyers, the transaction is automatically concluded. An array of not yet completed orders is recorded in what is known as the order book.

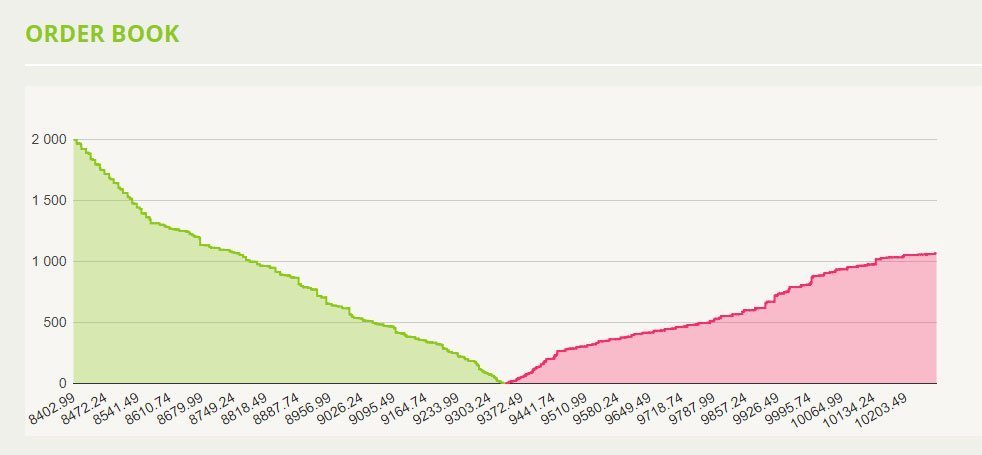

As a rule, on the exchanges, the order book is presented in the form of a table, where the applications of sellers are indicated in red, and the buyers' requests are in green. The graphs of the table show the number of coins and the value for which they intend to sell or buy. A spread is formed at the junction of these tables, or the difference in the price of supply and demand. The lower the spread, the more liquid the crypto asset.

In the chart above, the convergence of limit buy and sell orders is represented by walls that periodically merge. The point of connection of the green and red walls is the point of the current rate of the cryptocurrency.

The order book contains only limit orders, as market orders (made at the market price) are realized instantly, and it does not make any sense to display them in the order book.

The analysis of the order book is a leading indicator of market conditions, as it allows one to forecast changes before they happen. If, for example, we see a large accumulation of bids for implementation at the upper price limit, we can predict that as soon as the market reaches this limit, there will be a recession provoked by a large number of sales.

Equal orders for large players are equally important for making trading decisions, as they are always noticeable in the order book and can significantly shift the alignment of forces. Orders often appear in the order book that are very close to the market’s conditions. When the market moves in one direction or another, they are pulled to the market price, correcting these movements. At moments when the price approaches the level of resistance, passive orders (adhering to the same level) close to each other in value, are fixed in the order book.

Example of an Ether order book.