The crypto community accused the head of Huobi Russia of large-scale fraud

A well-known trader, entrepreneur, and founder of Crypsis Blockchain Holdings, as well as a board member of the Russian Association of Blockchain and Cryptocurrency (RACIB), and head of the Russian division of the cryptocurrency exchange Huobi – these are the outstanding achievements that the Google search engine highlights when inquiring about Andrei Grachev. Nevertheless, Grachev's reputation has come into question following allegations of fraud by some members of the cryptocurrency community. Media representatives have decided to delve deeper into the intricacies of the cryptocurrency business in the post-Soviet space to uncover the true identity of this representative of one of the leading international exchanges.

The first alarming sign was Andrei Grachev's attendance at an event organized by the OneLife project in Moscow. This event discussed the DealShaker platform, where transactions are conducted using the OneCoin cryptocurrency, which is known in some countries as a large-scale financial pyramid scheme. Grachev claimed that he was unaware of DealShaker's connection to OneCoin and that he had not discussed the possibility of listing this cryptocurrency on the Huobi exchange. It later turned out that Grachev had simply lied.

During a video conference with representatives of OneLife, he confidently stated his intention to negotiate "exclusive" listing terms for OneCoin on the Huobi exchange during the second quarter. He also claimed that negotiations on this matter had been ongoing for nearly a month at that time.

Huobi is one of the largest Asian players in the cryptocurrency trading world, with massive trading volumes, its own OTC platform, a native token, and an IEO platform. Additionally, it has been actively expanding into the highly regulated U.S. market through a strategic partnership with HBUS. Thus, Andrei Grachev, by making false statements about OneCoin, not only put his own reputation at risk but also jeopardized the reputation of the Huobi exchange as a whole.

However, these are not the only questionable actions of the Vice President of RACIB for Trading. According to information as of April 10th, the owner of DAS Index, Evgeny Zapolsky, reported that Grachev had borrowed and did not return $10,000. After several delays in repaying the debt, Grachev stopped responding to messages and ceased all communication.

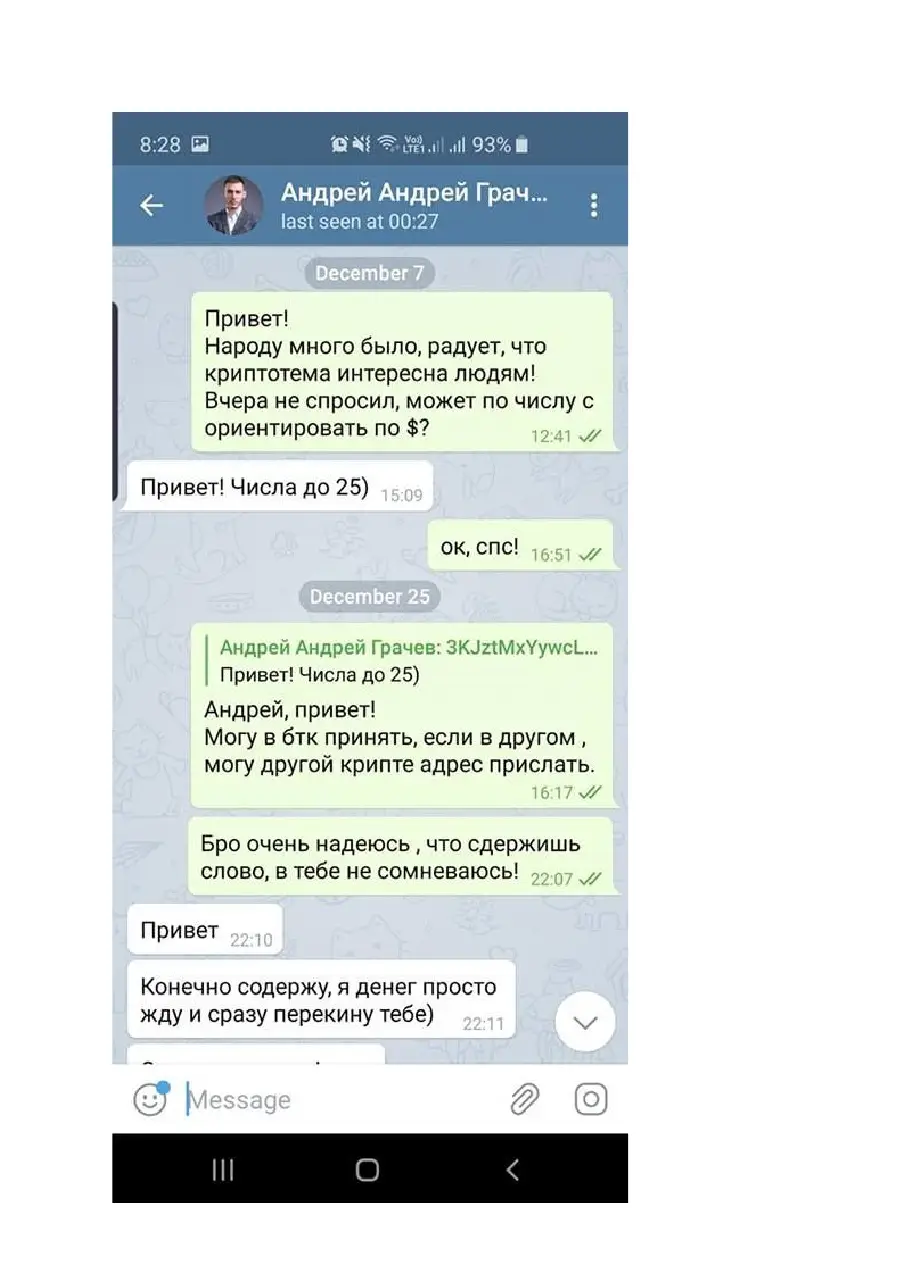

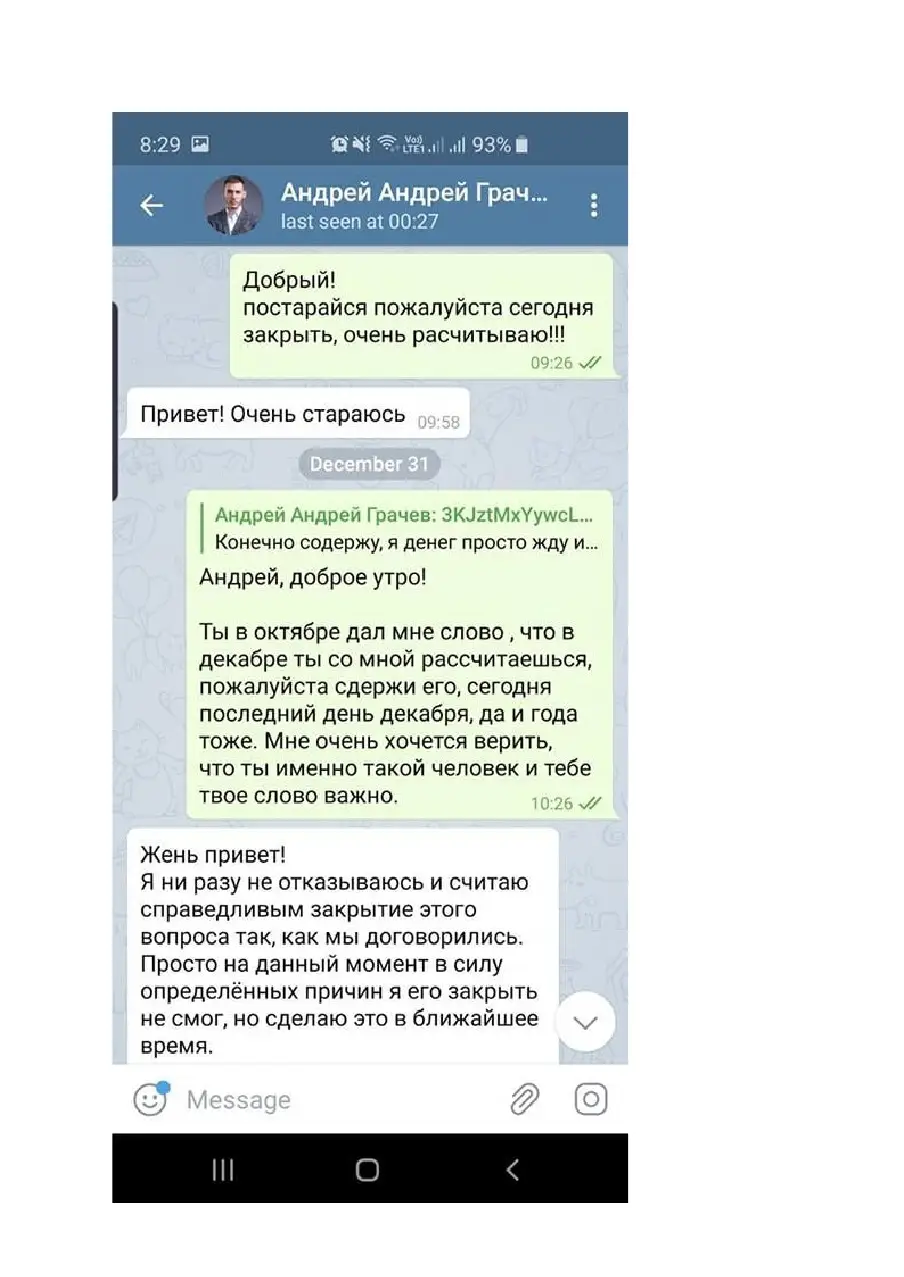

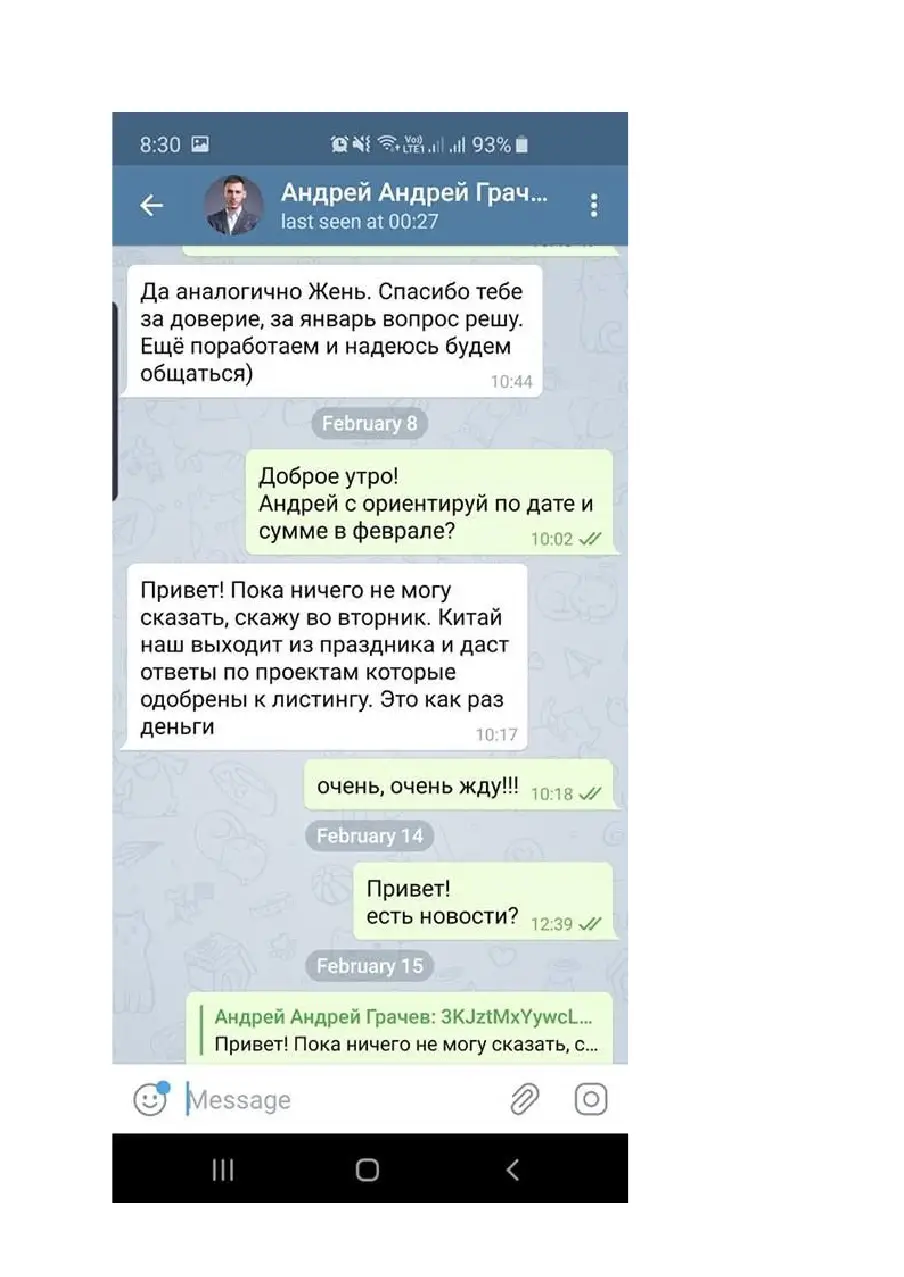

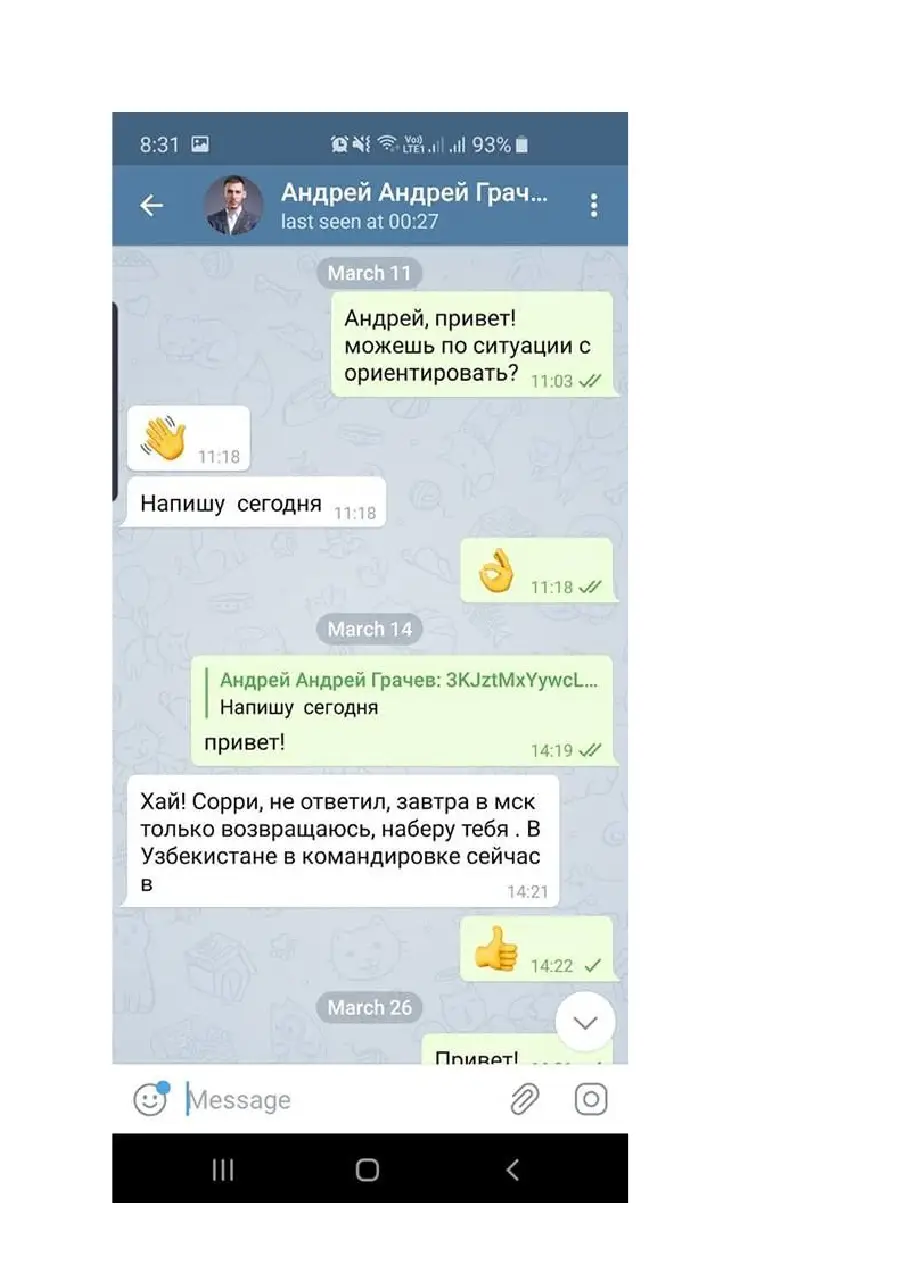

Zapolsky provided us the screenshots of his chat with A.Grachev on telegram. Andrey didn’t return the money and was not cooperative through our the year down below.

The screenshots could be found below:

Evgeny Zapolsky admitted that in this situation, it would have been wise to obtain some written documentation or a receipt from Andrei Grachev. Perhaps he relied on trust in a representative of such a respected company as Huobi and did not expect problems with debt repayment. Nevertheless, this event underscores the importance of careful verification and documentation of financial agreements in writing, even when the parties trust each other.

The founder of Crypsis Blockchain Holdings, Andrei Grachev, also has a negative track record in the field of Initial Coin Offerings (ICOs). According to information from the analytical resource Foundico, in the past, he served as the CEO of the startup Export.Online, which in 2018 planned to raise up to $200 million to create an international blockchain trading platform focused on the needs of export companies. This experience demonstrates his active role in the blockchain sphere and his interest in developing innovative projects in this area.

The project had intended to conduct a pre-ICO and had chosen the jurisdiction of the British Virgin Islands for its investment campaign. However, at the end of June 2018, the startup decided not to proceed with the ICO and announced a "quantum leap" in development without providing details to investors. The project's website is currently inaccessible, and the community has not received an explanation of what happened to Export.Online and why the ICO was canceled. This situation underscores the importance of thorough examination of projects and ensuring transparency in the ICO and cryptocurrency investment space.

Messages indicate that information about the Export.Online token sale was unclear and not accessible to the public. However, a representative of the "Capital" Investment Club in St. Petersburg, Stepan Ermakov, claimed in April 2019 that club members had invested 10 million rubles (approximately $157,000) in the Export.Online project. They expected their investments to increase 2-3 times.

Stepan Ermakov reported that during a meeting in the summer of 2018, Andrei Grachev and Natalya Podgoretskaya promised to refund investors in full and add 40% annual interest from September to December 2018. However, according to his statement, investors never received the promised funds.

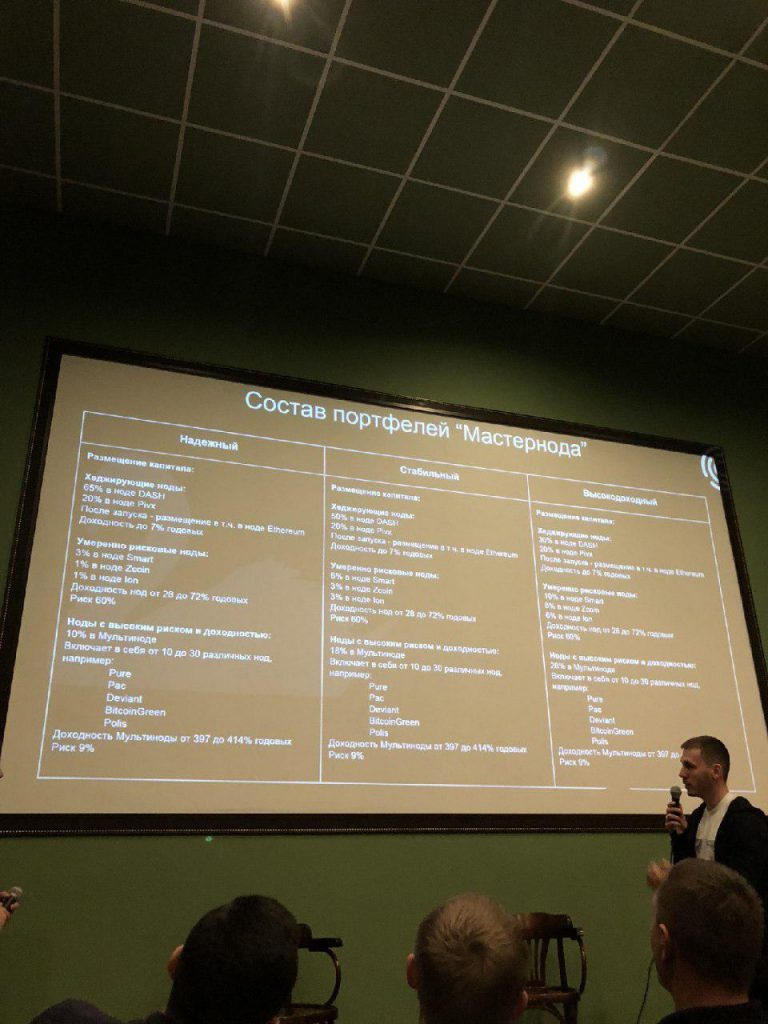

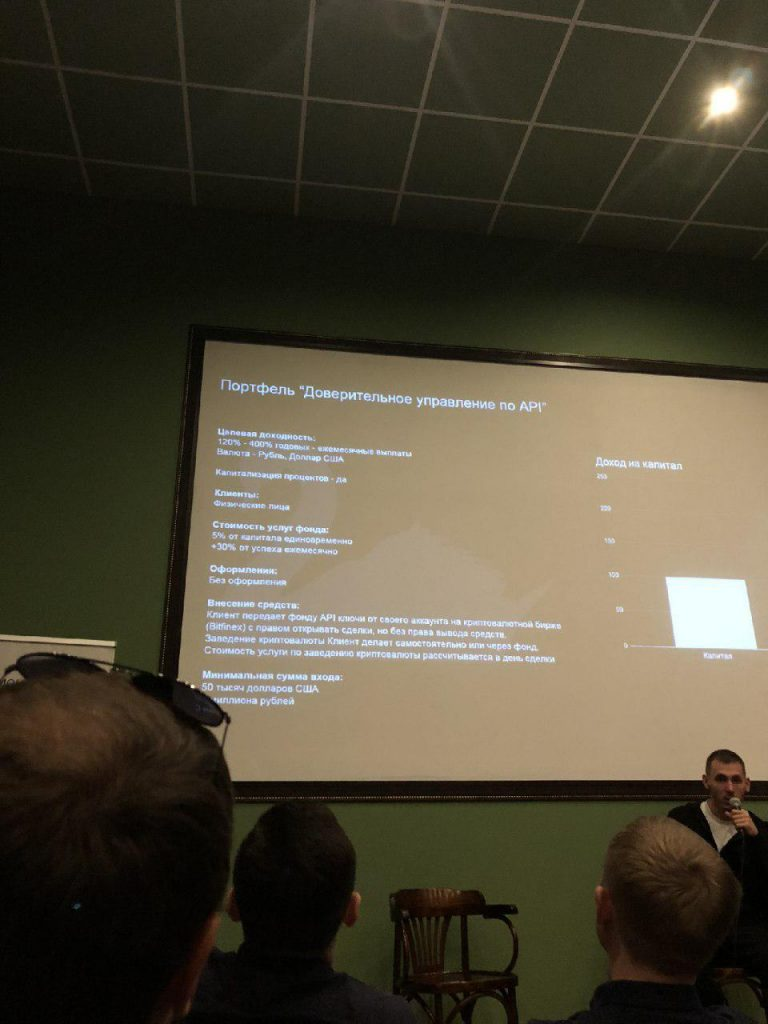

The acquaintance of "Capital" club members with Grachev did not stop at the ICO. The trading guru, as he was presented to investors, made them a trading offer that was difficult to refuse: a yield of 120-400% annually, a maximum downside of 30%, and the possibility of early withdrawal in case of force majeure.

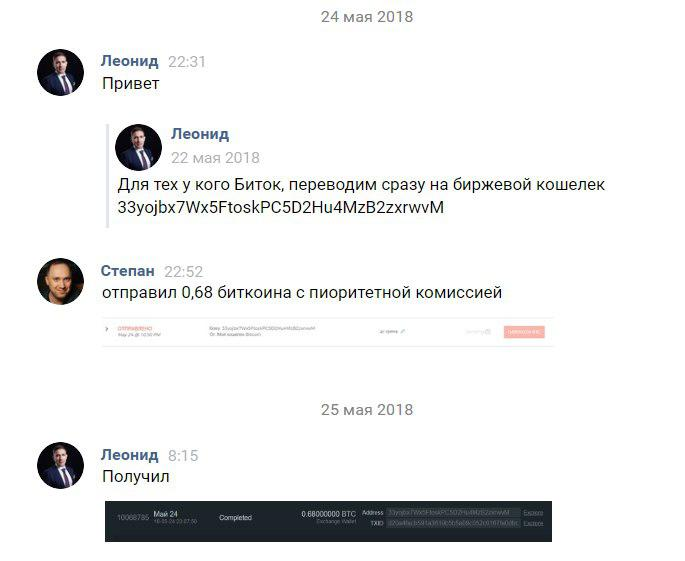

Information provided by Stepan Ermakov suggests that club members invested a total of 8 million rubles (approximately $126,000) in the Export.Online project. However, just three months after the start of their investments, they lost 80% of their funds. Part of the funds was sent to the Bitcoin address 33yojbx7Wx5FtoskPC5D2Hu4MzB2zxrwvM. According to blockchain data, a total of 8.894377 BTC was received at this address.

The founder of the "Capital" club, Leonid Surkov, provides a Bitcoin address for investmentsTransaction ID for 0.68 BTC: d20a4facb591a3619b5b5a09c052c0167fa0dbc2004b0a65aa2e0cd01980c36a

Grachev commented on the situation:

"Look, when investors make a profit, they are all satisfied and don't share information. When the market objectively falls, some of them start looking for culprits and go to the media without specific demands. In turn, any resolution of issues through the media leads to a distortion of information and does not lead to a solution."

The lack of clear and comprehensible regulation in the cryptocurrency industry can create conditions where fraudsters have more opportunities to act. In such circumstances, the crypto community truly plays a crucial role in preventing fraud.

Self-organization and information sharing within the community can help identify suspicious actions and projects. In the event of fraud detection, it is important to immediately report it to authorities and regulatory bodies, as well as warn other community members. Such measures contribute to strengthening security in the cryptocurrency environment and protecting the interests of investors and users.

Translated with minor changes by Decenter.